Using the assistance of a trading robot

Posted by Jeremy Rush.

What is Trading?

What is Trading?

Everybody is familiar with the term “trading”. Most of us have traded in our everyday life, although we may not even know that we have done so. Essentially, everything you buy in a store is trading money for the goods you want.

The principles of trading

The term “trading” simply means “exchanging one item for another”. We usually understand this to be the exchanging of goods for money or in other words, simply buying something. When we talk about trading in the financial markets, it is the same principle. Think about someone who trades shares. What they are actually doing is buying shares (or a small part) of a company. If the value of those shares increases, then they make money by selling them again at a higher price. This is trading. You buy something for one price and sell it again for another — hopefully at a higher price, thus making a profit and vice versa. But why would the value of the shares go up? The answer is simple: the value changes due to supply and demand – the more demand there is for something, the more people are willing to pay for it.

Increase in demand means an increase in price

I can explain this using a simple everyday example of buying food. Let’s say you are in a market and there are only ten apples left on a stall. This is the only place where you can buy apples. If you are the only person and you only want a couple of apples, then the market stall owner will most likely sell them to you at a reasonable price. Now let's say that fifteen people enter the market and they all want apples. To make sure that they will actually get them before the others do, they are willing to pay more for them. Hence, the market stall owner can put the price up, because he knows that there is more demand for the apples than supply of them.

Once the apples reach a price at which the customers think they are too expensive, they will then stop buying them. When the market stall owner realises that he is not selling his apples anymore because they are too expensive, he will stop raising the price and it may come back down to a level, at which customers will start to buy the apples again.

Increase in supply means a decrease in price

Let’s say that suddenly another market stall owner comes into the market and has even more apples to sell. The supply of apples has now increased dramatically. It stands to reason that the second market stall owner may want to sell apples at a cheaper price than the first stall owner to entice customers. It also stands to reason that the customers would probably want to buy at the lower price. Seeing this, the first stall owner will most likely bring his prices down. The sudden increase in supply has therefore brought the price of the apples down. The price at which demand matches supply is called the “market price”, i.e. the price level at which both the market stall owner and the customers agree on both a price and number of apples sold.

Application to the financial & Crypto markets

The concept of supply and demand is the same in the financial & Crypto world.

If a company or a coin posted some great results and is paying very good dividends, then more people want to buy the shares of the company or coin. This increased demand will lead to an increase of the price of those shares or coins.

What is online trading?

For a long time financial trading was purely conducted electronically between banks and financial institutions. This meant that trading in the financial markets was closed to anyone outside of these institutions. With the development of high speed Internet, anyone who wanted to become involved in trading was able to do so online.

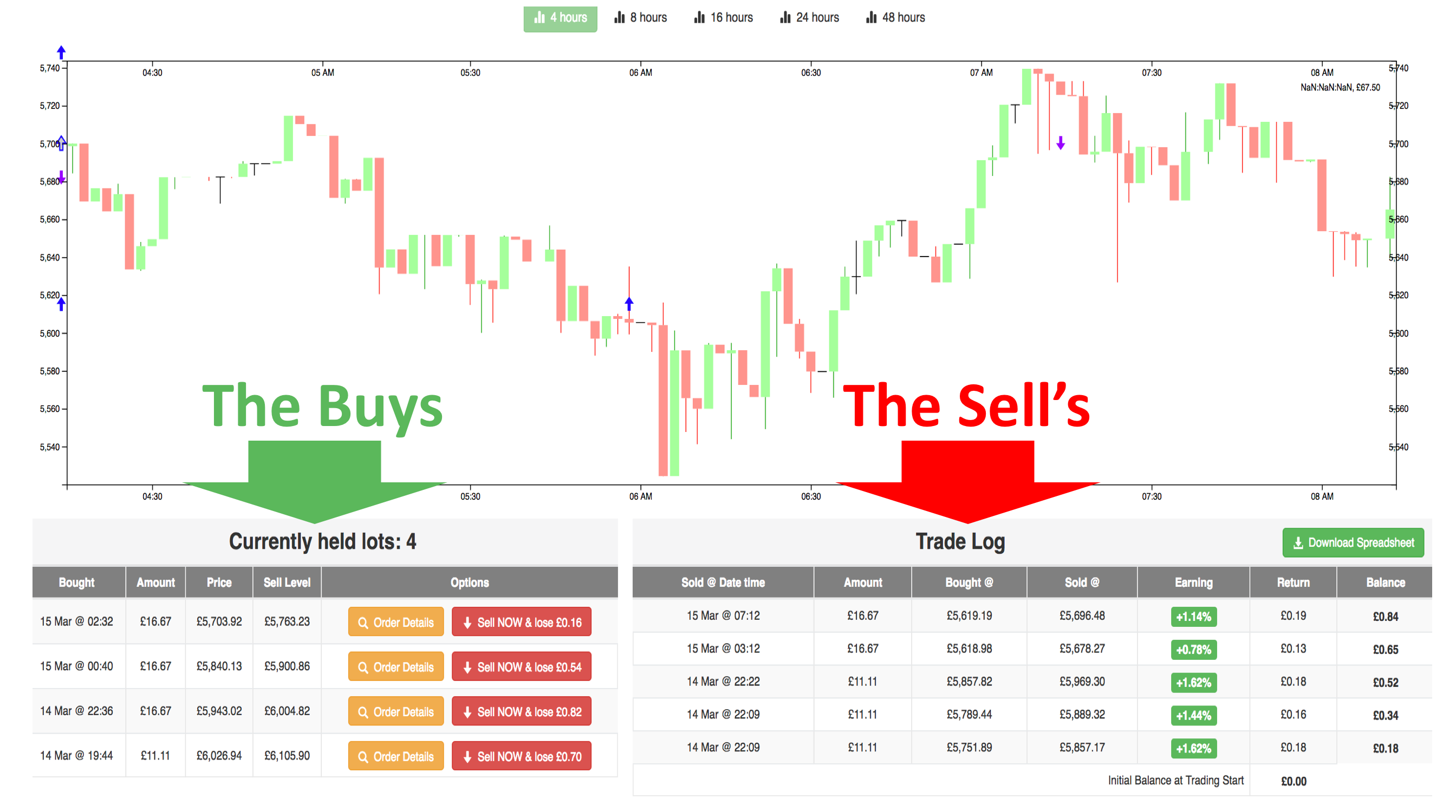

But where do you start ? And how do you know when to buy and when to sell, thats where a trading robot comes in.

Before we go any further we need to understand what a robot can NOT do

Increase demand for a coin to increase it in price

Increase in supply of a coin to decrease it in price

A trading robot can not create miracles.........

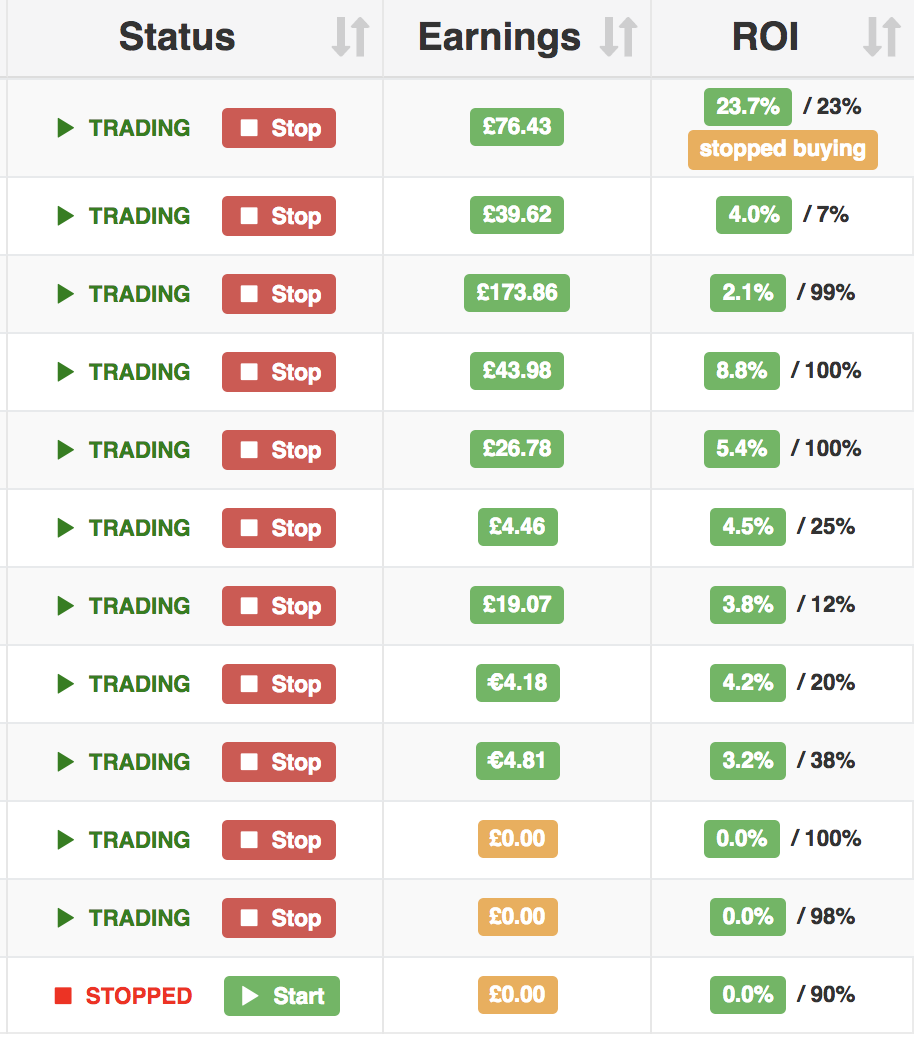

The Zukul-trading was created to assist you and provides the following benefits:

- Trades executed at the best possible prices

- Instant and accurate trade order placement (thereby high chances of execution at desired levels)

- Trades timed correctly and instantly, to avoid significant price changes

- Reduced transaction costs

- Simultaneous automated checks on multiple market conditions

- Reduced risk of manual errors in placing the trades

- Backtest the algorithm, based on available historical and real time data

- Reduced possibility of mistakes by human traders based on emotional and psychological factors

.png)